Source: Moneycontrol.com

The contraction seen in discretionary demand poses a major worry for Aarti Industries

Highlights

- Q1 results affected by Covid-related disruptions and soft demand

- Near term outlook uncertain due to high share of cyclical end market

exposure

- Medium term earnings outlook of 15-20% growth

- Long term prospects due to

China opportunity remains intact

Aarti Industries’s (CMP: Rs 1,000, Mkt Cap: Rs

17,389 crore) performance paused due to heightened uncertainty around demand

for aromatic chemicals. While the specialty chemicals’ company can benefit from

the opportunity to substitute China as a source for the pharmaceutical and

chemical products, it warrants a relook due to the recent termination of a long

term contract, high exposure to cyclical sectors and elevated valuation.

Table: Q1 financials - consolidated

Key highlights of Q1 results

Aarti’s Q1 revenue declined by about 10 percent YoY

due to soft end-market trends and Covid-19 related restrictions. The specialty

chemicals segment which constitutes 81 percent of sales de-grew by 11 percent,

largely due to the lockdown’s impact and lower capacity utilization. The pharma

segment, which accounts for the rest of sales, grew by 2 percent only.

Overall, EBITDA (Earnings before interest, tax,

depreciation and amortization) margins were severely affected by higher

operational costs for new facilities and operational deleverage. This partially

explains the drop in segmental operating profit margin for the specialty

chemicals segment to 15.5 percent (-711 bps). However, the pharma segment

continued to exhibit improvement in this metric to 23.2 percent (+644 bps) due

to increased share of value-added products.

Other observations:

Among key capex projects, the chlorination plant

project at Jhagadia is expected to be live in the current quarter. Other

investment projects include that for pharma, NCB (Nitro Chloro Benzene) and for

executing multi-year contracts,

A long term contract worth Rs 10,000 crore for a

20-year supply of chemical intermediates is expected to be commissioned in H2

FY21. Investments towards the NCB value chain would be completed in two phases.

The first one is to be completed in the current fiscal and the second one by H2

FY22. The NCB capacity is targeted to increase to 108,000 tonnes from 75,000

tonnes with an investment of Rs 150 crore.

Additionally, with the enhancement of R&D

capabilities, the company expects to enter new lines of chemistry and products.

The focus will be on supply chains for value-added products requiring multiple

levels of synthesis and completely independent of intermediate supplies from

China.

In case of the pharma segment, the company is

looking for API (Active Pharmaceutical Ingredient) and intermediates’ capacity

expansions catering to therapies such as antihypertensive, cardiovascular,

oncology and corticosteriods. It is also looking to capture increased

domestic sourcing of pharma intermediates by clients due to the China factor.

The government’s incentive scheme for APIs is also going to help in higher

demand for intermediates from domestic manufacturers.

Outlook

The management has updated that a large part of the

operational hurdles in terms of logistics and labour availability have been

sorted and capacity utilization is now nearing 90 percent. Looking beyond the

termination of a multi-year contract, it is comforting that the progress in

other projects remains directionally on track and is backed by a capex budget

of Rs 1,000 -1,200 crore in the current year.

Having said that, the contraction seen in

discretionary demand is a major worry for a diversified chemical producer such

as Aarti industries. In the quarter gone by, sales were skewed towards pharma

and agrochem end-markets, which in the normal course contributes about 40

percent of sales. Demand for some relevant applied sectors for chemicals such

as auto, textiles, polymers, construction electronics, oil & gas and

aerospace remain uncertain for the current year.

However, the management believes that Q1 FY21 was

the worst quarter in terms of business impact and expects to see sequential

volume growth in Q2. It is projecting positive EBITDA growth and flattish net

profit growth in FY21 due to rising depreciation and interest expenses. Over

the medium term (3-4 year time horizon), the management is projecting 15-20

percent earnings CAGR using FY20 as a base.

While we remain skeptical about the shorter term

prospects, the longer term guidance seems plausible as current crises adds to the

growing theme of India as an alternative base for sourcing chemicals.

Additionally, large chemical players such as Aarti industries are better

positioned to deal with near term hurdles with respect to operations, supply

chain and working capital management, helping it gain market share in the

domestic market.

In the long term, the company is well placed to

capture this opportunity due to its increasingly vertically integrated model.

It is working on 15-20 downstream products aimed at capturing the domestic

demand opportunity through import substitution. It is also exploring newer

chemistry value chains such as the chlorotoluene chain.

Among factors that require close attention are

leverage (Net debt/Equity: 0.52x) and the promoter’s stake. Promoter’s shareholding

has been reducing over the years. In the June’20 filing it was 47.45 percent

compared to 51.07 percent in March’18 filing.

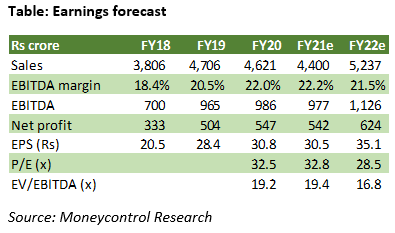

As far as the stock is concerned, it currently

trades at an expensive valuation of 16.8x FY22 EV (Enterprise

Value)/Ebitda. Although the company presents a promising structural

opportunity, weak near term earnings visibility warrants waiting for better

levels to accumulate.

Comments

Post a Comment