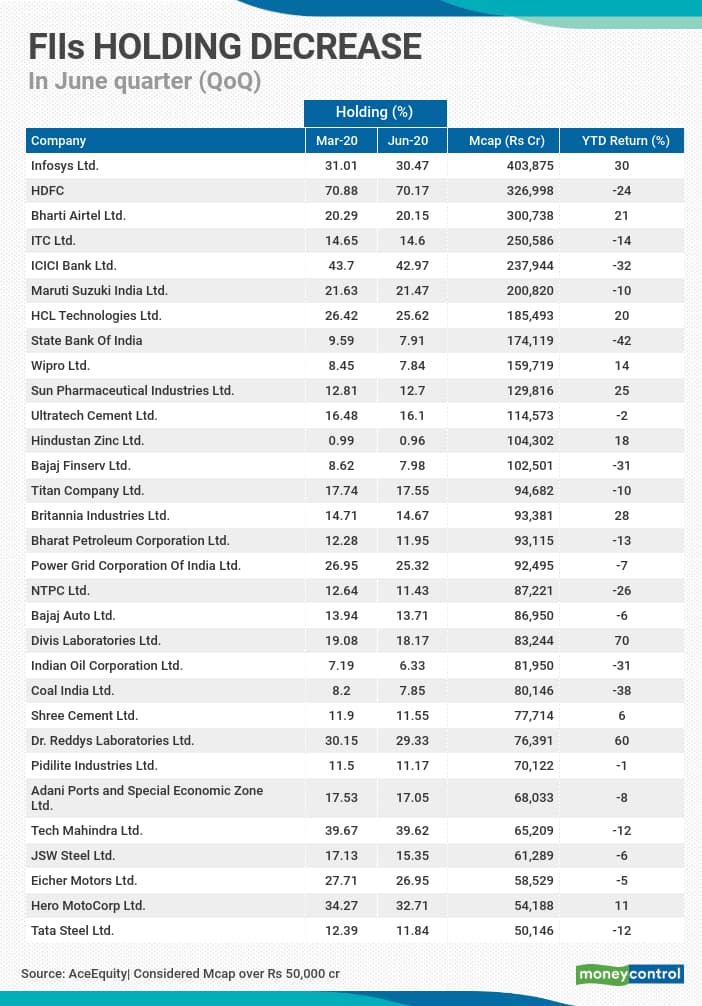

The 31 companies where FIIs have pared their holdings include Infosys, HDFC, ICICI Bank, ITC, Bharti Airtel, Bajaj Finserv, Titan Company, Eicher Motors and Tata Steel.

Foreign institutional investors

(FIIs) pared stake sequentially in some of the prominent large-cap companies in

the June quarter, data from AceEquity showed

From the universe of companies

having a market capitalisation of more than Rs 50,000 crore, there are as

many as 31 names in which FIIs pared their holdings. These include Infosys, HDFC, ICICI

Bank, ITC, Bharti Airtel, Bajaj Finserv, Titan Company, Eicher

Motors and Tata Steel.

Out of 31 companies, 19

have been trading lower so far in 2020. These include SBI, Coal India,

ITC, Tata Steel, Tech Mahindra and IOC.

The rest 11 companies have

given positive returns in 2020 so far, including Divi’s Laboratories, Dr.

Reddy’s Laboratories, Infosys, Britannia, and HCL Technologies.

Does that mean that investors

should turn cautious?

Well, experts are of the view

that if we look at the data, FIIs have reduced the stake marginally which could

be attributed to the rebalancing of portfolio, or booking profits amid the rise

in valuations. Hence, the paring of the stake should not be viewed negatively.

“In most of the large-cap names

where FIIs have reduced exposure the percentage reduction is very miniscule.

This could be due to the continued selling and rotation seen in April even

after the March month selling,” Rusmik Oza, Executive Vice President, Head of

Fundamental Research at Kotak Securities told Moneycontrol.

“One cannot infer or draw any

conclusion that these companies' growth model has become weak because of the

minor reduction in FII holding. At times we see a rotation of flows within the

large-cap space and last three months have been exceptional due to the pandemic

crisis,” he said.

Oza further added that some of

the minor reduction in exposure can get corrected in the September quarter as

many of the laggards and underperforming large caps have rebounded sharply in

July and August.

Other

factors to track:

Tracking what Foreign

institutional investors are doing is a good thing, but that should not be the

only basis of making a buy or sell decision, suggest experts.

Investors should ideally see a

trend for 3-4 quarters rather than basing their decision on statistics of one

quarter, they say. There may be many factors why FIIs decided to reduce stake;

hence, investors should do their own research before pressing buy or a sell

button.

“There are many NIFTY-50

heavyweights where we have witnessed reduced exposure of FIIs but growth might

play a vital role in the future and might drive benchmark indices. In my

opinion, investors should wait at least 2-3 quarters before making any decision

and question on a growth model,” Gaurav Garg, Head of Research at CapitalVia Global

Research Limited told Moneycontrol.

“Investors should look for a

good business driven by a good set of people who will always deliver good

returns in the longer run. Corporate governance plays an important role when it

comes to the sustainability of the business. Higher potential in earnings

growth is always a good sign to invest in stock and hold for the long run,” he

said.

Ajit Mishra, VP Research,

Religare Broking told Moneycontrol that apart from FII holding, investors must

look at various other factors such as its fundamental track record, financial

leverage, and return ratios (particularly debt to equity).

“Further, it has also become

very important to check on whether the company is facing any corporate

governance issues as this leads to sharp valuation correction. Also,

buying/selling would depend on what valuations the investor is interested in

the stock and whether it is justified,” he said.

Disclaimer: The views and investment tips expressed by experts on

Moneycontrol.com are their own and not those of the website or its management.

Moneycontrol.com/SD Solutions advises users to check with certified experts

before taking any investment decisions.

Comments

Post a Comment