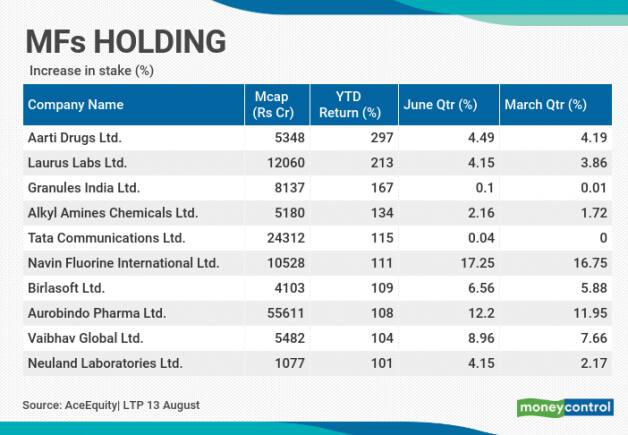

Most of the stocks in which fund managers raised stake in the June quarter are from the small & midcap space belonging to chemical and pharma sectors.

Fund managers were quick to

spot the beaten-down stocks and raised stake in as many as 287 companies in the

June quarter, data from AceEquity showed as on August 13.

Out of 287, there are 10

companies whose stocks have rallied more than 100 percent so far in 2020.

These are Aarti Drugs, Laurus Labs, Granules India, Alkyl

Amines, Tata Communications, Navin Fluorine, Birlasoft, Aurobindo

Pharma, Vaibhav Global and Neuland Laboratories.

Most of the stocks in which

fund managers raised stake in the June quarter are from the small & midcap

space. After a sharp sell-off in March, the broader market was first to bounce

back to show signs of strength.

Most of the companies which

have doubled in 2020 belong to either the chemical sector or companies that

manufacture API from the pharma space. Both these sectors are likely to benefit

most from the COVID-19 pandemic and the government policies.

“As market started to stabilise after March,

investors – foreign and domestic – found good quality, high growth stocks at

affordable valuations. Indian government went into a fire-fighting mode to

protect the lives and livelihood of citizens, loan moratoriums were announced,”

Tejas Khoday, Co-Founder & CEO, FYERS told Moneycontrol.

“Timely approvals from USFDA,

decent sales, scarcity of Active Pharmaceutical Ingredients (APIs) boosted the

growth prospects of these companies even as India went into lockdown with

stringent conditions,” he said.

Khoday further added that among

the top 10 outperformers of the quarter, most were from pharma or

chemical-related stocks. Tata Communications, Vaibhav Global, Birlasoft were a

value play.

(The

above table is for reference only and not buy or sell recommendations)

Analysts also pointed out

towards rotation trade happening in the June quarter. Fund managers moved out

of largecaps in the financials and consumption space towards growth stocks in

the small & midcaps space which are likely to see a big turnaround as

economy recovers.

“With a lot of large caps

rallying back to pre-COVID levels, and a lot of these stocks in sectors like

financials and industrials which could see further stress in the future, or a

discretionary consumption drought, Siddharth Panjwani, Chief Strategy Officer

Pickright Technologies told Moneycontrol.

“MFs have responded by rotating

out of them into the more growth oriented sectors with better prospects as seen

in the stocks above,” he said.

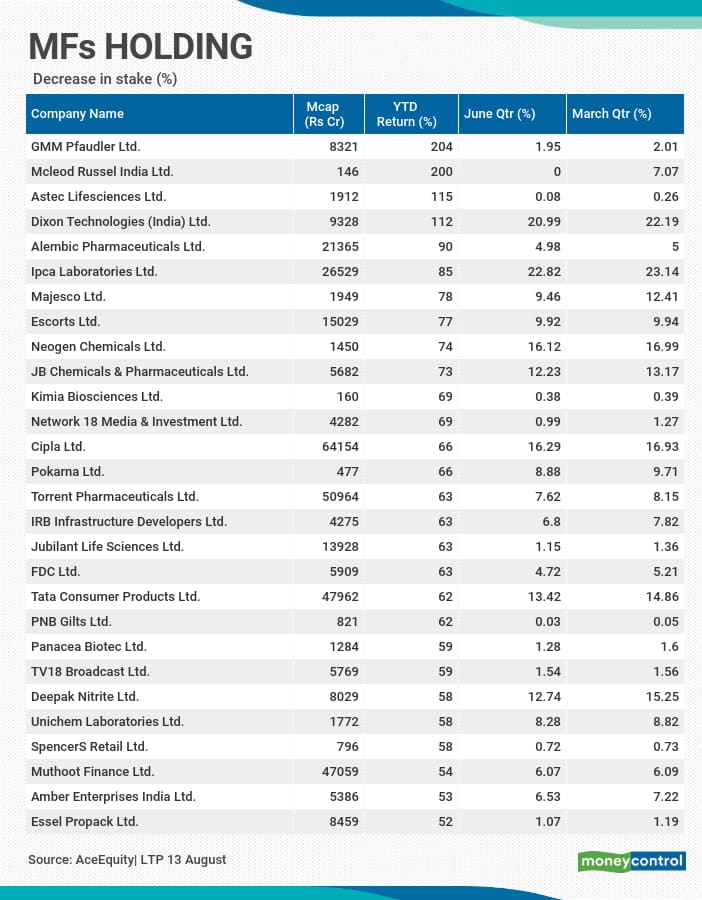

Decrease

in stake:

There are as many as 363

companies in which fund managers reduced their stake in the June quarter,

according to data collated from AceEquity. Out of 363 companies, 4 more than

doubles investors' wealth so far in the year 2020.

Stocks which more than doubles

investors’ wealth include names like GMM Pfaudler, Mcleod Russel, Astec

Lifesciences, and Dixon Technologies. Most of the companies have been hitting a

fresh record high in August as well.

While MF buying and selling is

a good signal, this information is also dated and might not reflect what the

fund manager is doing in real-time, suggest experts. Also, sometimes fund

managers adjust the portfolio to manage risk amid high valuations.

“Except for companies belonging

to the Chemical and Pharma sector where we can see exponential growth in the

medium to long term valuations of most of these stocks looks stretched and it

will be advisable to book profits,” Atish Matlawala, Sr Analyst, SSJ Finance

& Securities told Moneycontrol.

There are as many as 24 stocks

in which fund managers reduced their stake rose more than 50 percent so far in

the year 2020 that include names like Amber Enterprises, Essel Propack,

Jubilant Lifesciences, Cipla, JB Chemicals, Escorts, Ipca Laboratories, and

Alembic Pharma.

(The

above table is for reference only and not buy or sell recommendations)

Most of the stocks belong to

the chemicals, infra as well as pharma space which have benefitted immensely

from the Atmanirbhar schemes, as well as the outbreak of COVID.

Experts are of the view that

fund managers preferred to book some profits in some and deployed the cash in

those sectors which will bounce back as and when the economy recovers.

“A quick glance of these 364

stocks reveals that the stocks are part of a sectoral move and belong to

pharma, agro and specialty chemicals, consumption-related sectors. Atmanirbhar

Bharat Abhyan and lockdowns have provided the necessary impetus to many of

these stocks,” says Khoday of FYERS.

“As lockdowns end and economy

starts opening up fully, companies from other sectors which are undervalued or

are fairly valued could get preference. Hence, investors would be interested in

booking partial profits or retrieve their initial capital, which could be

deployed in value offering stocks,” he said.

Disclaimer: The views and investment tips expressed by experts on

Moneycontrol.com are their own and not those of the website or its management.

Moneycontrol.com/SD Solutions advises users to check with certified experts before taking

any investment decisions.

Comments

Post a Comment