Experts are of the view that a repeat of 2020 or what happened in March might not be possible but some consolidation cannot be ruled out.

Back in March when everyone wanted to write-off 2020 from their books, hope and liquidity supported markets and investor sentiment. Nobody thought that after touching a 3-year low in March 2020, benchmark indices would give double-digit returns by the end of the year.

The S&P BSE Sensex and Nifty50 rallied by about 15 percent in 2020 and the big outperformance came from the small and midcap stocks. The rally is still continuing in 2021.

The S&P BSE Sensex, which climbed Mount 49K, is up over 3 percent while the Nifty50 is up over 4 percent so far in January.

Sensex scaling the 49,000-mark and Nifty50 touching 14,500 levels ahead of the Budget 2021 could make anyone cautious about the strength of the rally. Back in January 2020, both Sensex and Nifty touched fresh highs ahead of Budget, and then the market fell like a pack of cards.

The big question now is – will history repeat itself? Well, experts are of the view that a repeat of 2020 or what happened in March might not be possible but yes some consolidation cannot be ruled out.

"But, in the current scenario, there is lesser economic uncertainty than it was during the start of COVID and lockdown. Therefore, a healthy and technical correction is possible which is expected to rationalise the sentiments on street and give way to realistic valuations," he said."COVID-19 is an extraordinary event and therefore anticipation of such events would be futile. However, it is only fair to expect a correction because it is quite evident that markets are in the overbought zone," Rohit Gadia, CIO at CapitalVia Global Research Limited told Moneycontrol.

More than Rs 1 lakh crore of foreign money hit D-Street which pushed benchmark indices to new record highs back in November 2020, and since then there was no looking back.

Improving micro as well as macro factors also support the sentiment along with stability in earnings despite COVID-hit quarter also lifted the sentiment. With the rollout of vaccines, hopes are built-in for a swifter economic recovery across the globe.

“Events such as COVID cannot be forecast or anticipated. There is no doubt that the market's valuation is on the higher side. Money flow by FPIs and HNIs is fuelling this rise anticipating economic turnaround for India in the ensuing quarters,” Deepak Jasani, Head of Retail Research, HDFC Securities told Moneycontrol.

The market seems to be pricing in earnings recovery and successful rollout of vaccination drive which will start this month, and any disappointment from Budget could have a short knee-jerk reaction at best.

The Nifty50 could retest crucial support levels in the event of a knee-jerk reaction but a vertical fall of what we say in March looks unlikely unless there is some global disappointment.

“It is very hard to tell whether history would repeat like that of past year but the fall witnessed in March-2020 was definitely once in a decade kind of event and the probability of such events repeating in a short time frame is very rare,” Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers told Moneycontrol.

“However, since markets are trading on all-time highs and we are already into results season with a budget just around the corner hence the next two months are very eventful as far as data is concerned and that would also have an impact on markets itself,” he said.

Valuations:

The Nifty ended CY20 with a 15 percent YoY gain, a solid performance in a year ravaged by the COVID-19 pandemic. The index witnessed a spectacular rally in 4QCY20 on the back of strong FII inflows and good corporate earnings.

Valuations indeed pose a threat to the rally that we have seen in 2020 without any meaningful change in earnings. But, since most dips are getting bought -- the rally will continue as long as liquidity is sufficient.

While FIIs inflows were at record highs, outflows by DIIs were at fresh highs too. FII inflows for CY20 were strong at USD23.4b – the highest since CY12, Motilal Oswal said in a report.

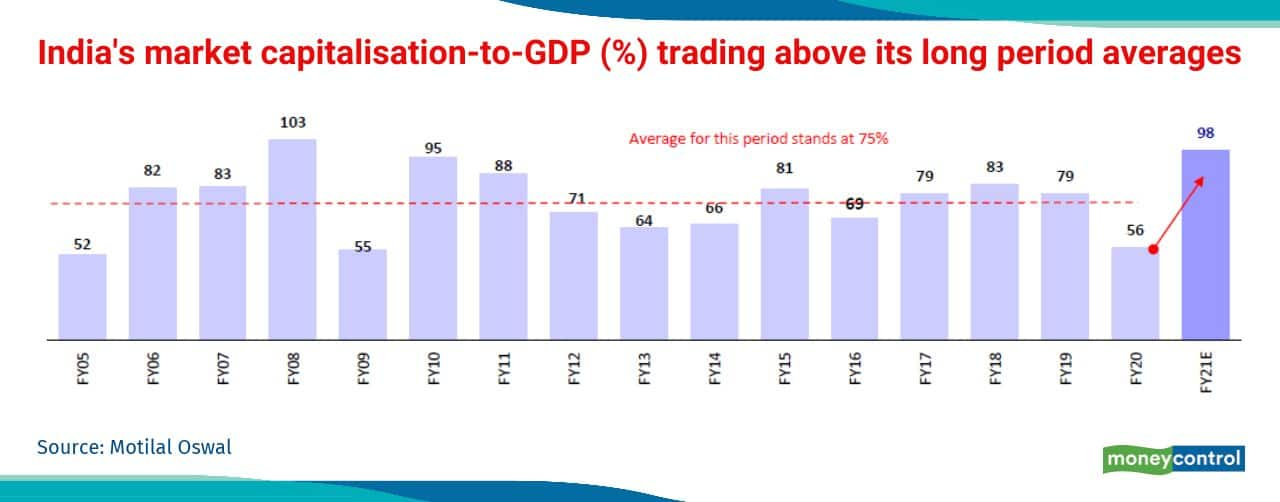

One factor that is tracked by investors is the Mcap-to-GDP indicator which is at a decade high. India’s market capitalisation-to-GDP ratio has been volatile as it moved from 79% in FY19 to 56% (FY20 GDP) in Mar’20 and now stands at 98% (FY21E GDP) – above its long-term average of 75% and highest since FY10, the report added.

In terms of valuations, the Motilal Oswal report highlighted that Nifty trades at a 12-month forward P/E of 21.4x, a 14 percent premium to its long-period average. Its P/B of 3x is at a 17 percent premium to its historical average.

The Nifty’s 12-month trailing P/E of 27.7x is at a 39 percent premium to its long-period average of 19.9x. At 3.3x, Nifty’s 12-month trailing P/B is above its historical average of 2.8x.

Comments

Post a Comment