The firm has got the nod for empagliflozin and linagliptin tablets. Empagliflozin is indicated to reduce the risk of cardiovascular death in adults with type 2 diabetes.

Alembic Pharmaceuticals share

price gained 3 percent intraday on August 27 after the pharma company

received a tentative nod for the US drug regulator for empagliflozin and

linagliptin tablets.

The company has received US

Food & Drug Administration (USFDA) tentative approval for empagliflozin and

linagliptin Tablets, 10 mg/5 mg and 25 mg/5 mg. Alembic now has a total of 130

ANDA approvals (113 final approvals and 17 tentative approvals) from the FDA,

the company said in an exchange filing.

Empagliflozin is indicated to

reduce the risk of cardiovascular death in adults with type 2 diabetes mellitus

and established cardiovascular disease. However, the effectiveness of empagliflozin

and linagliptin tablets in reducing the risk of cardiovascular death in adults

with type 2 diabetes mellitus and cardiovascular disease has not been

established, the company said.

Empagliflozin and linagliptin

tablets (10 mg/5 mg and 25 mg/5 mg) had an estimated market size of $244

million for twelve months ending June 2020, the company said, citing IQVIA

data.

The stock, which has gained 57

percent in the past six months, was trading at Rs 1,022.40, up Rs 31.60, or

3.19 percent. It has touched an intraday high of Rs 1,024.45 and an intraday

low of Rs 990.80.

The drug company on August 25

said its joint venture partner Aleor Dermaceuticals received final approval

from the US regulator for Desonide lotion used to treat a variety of skin

conditions. The approved Abbreviated New Drug Application (ANDA) is

therapeutically equivalent to the reference listed drug product DesOwen Lotion,

0.05 percent, of Galderma Laboratories LP.

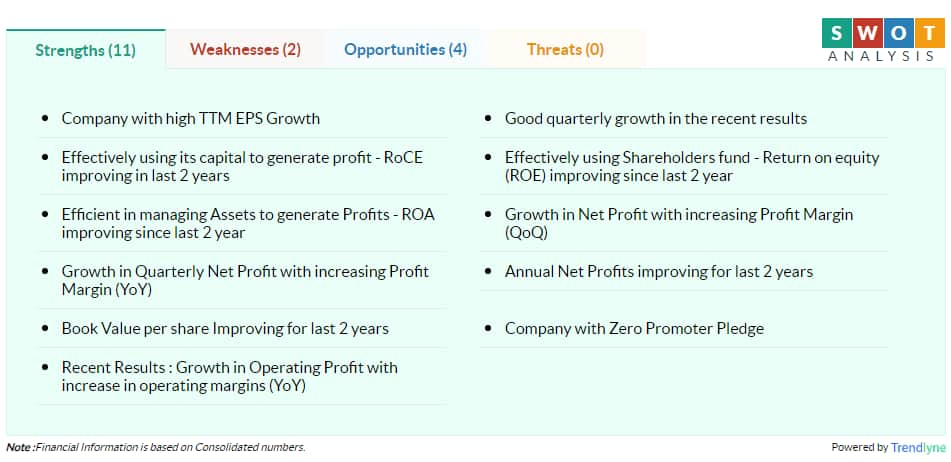

According to Moneycontrol SWOT

Analysis powered by Trendlyne, the company has zero promoter pledge with book

value per share improving for the past two years

Moneycontrol technical rating

is bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by

experts on moneycontrol.com are their own and not those of the website or its

management. Moneycontrol./SD Solutions com advises users to check with

certified experts before taking any investment decisions.

Comments

Post a Comment