Mas Financial stock is attractive and at a similar level to its IPO valuation, which is at a steep discount to its listing level of 2017

Highlights

- Underperformed Nifty in past seventy days

- No

negative surprise in earnings, except for Covid provision

- Asset

quality good so far, loan growth nosedives

-

Effective moratorium book 13 percent of assets by value

- Near

term credit cost might remain elevated

-

Valuation attractive for the long-term investors

Mas Financial (CMP: Rs 661

Market Cap: Rs 3617 crore) is one of the casualties of the COVID-19 pandemic in

the markets. The stock has not had a full-blown recovery; it is down 3 percent

in the past seventy days compared to an 11 percent gain for the Nifty. With

predominant lending to MSME and SME, the lockdown raised concerns about its

asset quality. This resulted in erosion of valuation from 4X forward price to

book at the time of listing in 2017 to 2.7X forward book now similar to its IPO

valuation. The first quarterly update amid a near-complete lockdown showed its

strength and resilience. Are investors missing an opportunity because of the

stigma attached to the NBFC space?

The

business

Mas Financial has stood out

time and again in the past in the midst of earlier crises and has only emerged

stronger. The business primarily focuses on loans to small businesses and

individuals. At present there are four product categories – micro enterprise

loans (MEL), SME (small & medium enterprise), two-wheeler loans and commercial

vehicle (CV) loans. The company also has a housing finance subsidiary catering

to affordable housing

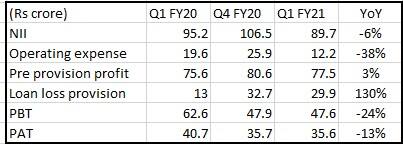

Quarter at a glance

Source: Company

The earnings report was prima

facie subdued as assets under management declined sequentially on negligible

disbursements and higher collection; excess liquidity in the balance sheet

suppressed interest margin and provisions shot up as the company set aside Rs

30 crore for COVID-19.

The company has gone extremely

slow on disbursement and did not lend at all in April and May. It disbursed a

paltry Rs 108 crore in June and Rs 88 crore in July.

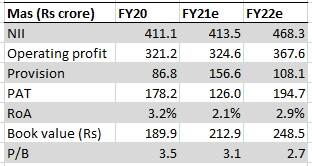

Source: Company

Thanks to the moratorium, asset

quality has not shown any signs of hiccups with gross and net stage 3 assets at

1.9 percent and 1.4 percent respectively, little changed from the previous

quarter.

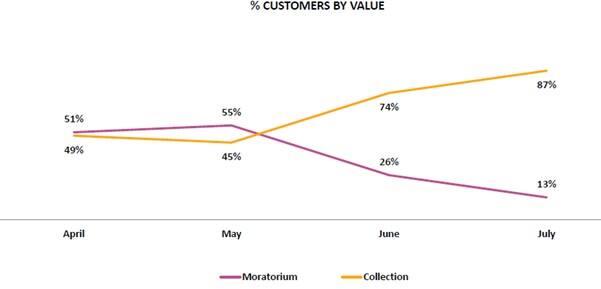

What is

moratorium book suggesting?

The company had offered

moratorium to all its borrowers and the collection efficiency picture has

turned reassuring.

Source: Company

The crux of the bad asset story

for Mas is that as on end July close to 13 percent of loans by value is not

being serviced which is close to Rs 407 crore and the company is carrying

COVID-19 provisions to the tune of Rs 51 crore or 12.5 percent of this

vulnerable book. That is just about sufficient to cover provisions required

should these loans be restructured. The total provisions on account of COVID

are close to 1.6 percent of on-book assets.

Another point of comfort is

that loans originated through NBFCs - close to 57 percent of the total assets

and a cause for worry in earlier months - had a very high collection efficiency

of 93 percent in July.

While the book is yet

completely out of the woods, the signs are encouraging and we feel the company

will definitely avoid a hard landing and can pass this difficult phase with a

temporary increase in provisions that is more than adequately captured in our

estimates.

Why

should investors look at Mas?

Calibrated

growth strategy

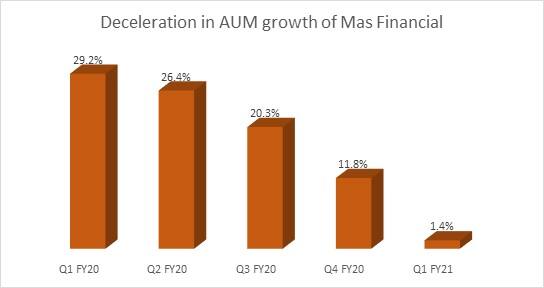

Over the last twenty five

years, the company has grown its book in a calibrated manner without taking on

unnecessary risk. Between FY09 to FY19, the loan book grew at a CAGR

(compounded annual growth rate) of 35 percent. However, given the macroeconomic

challenges, despite adequate liquidity in its balance sheet, growth slowed down

in FY20 and the company has been taking a very cautious stance in recent times

as the primary focus remains recovery and asset quality.

Well-

funded

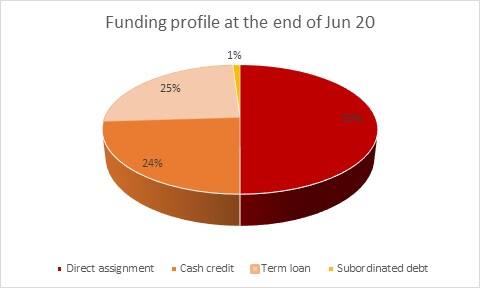

The company is extremely well

funded and has not availed of moratorium from its lenders and has enough

wherewithal to service its obligations for the next one year.

Its Capital adequacy remains

strong at 34.93 percent with tier 1 capital of 32.2 percent. As on 31st July, the

company had liquidity buffer of around Rs 1300 crore, unutilised cash credit

facility of Rs 700 crore and sanctions on hand to the tune of Rs 1125 crore.

Source: Company

Largely

a semi-urban &rural play

While COVID-19 has impacted

every business and every other region, it has been felt more in urban centres.

With 65 percent of the company’s books coming from rural and semi urban areas,

the chances of recovering early from the crisis are high.

Housing

finance subsidiary – no overt stress

Mas has a housing finance

subsidiary which is into affordable housing. This company has a small asset

book of Rs 284 crore and has shown no signs of asset quality deterioration so

far with gross and net Stage-3 assets at 0.36 percent and 0.26 percent

respectively. In terms of moratorium, as on end July, close to 17 percent of

on-book assets by value was not being serviced and it carries 4.5 percent

provisions on the same. This lending is secured and therefore, less of a

concern.

Attractive

valuations

While we acknowledge that the

road ahead may not be totally smooth, the management bandwidth, excellent track

record of handling multiple crises adeptly, strong capital position and

adequate funding makes us believe that this temporary phase shall pass with Mas

emerging stronger.

Source: Company, Moneycontrol Research

Valuations are attractive.

They are at a level similar to its IPO valuation which is at a steep discount

to its listing valuation of 2017. We feel Mas might not impress growth hungry

investors, but those looking for a predictable long-term compounding story

should look at gradually adding this company in their core portfolio.

Comments

Post a Comment