Of the 35 sectors classified by the BSE, foreign investors were net buyers in 14, 17 sectors saw outflows and four witnessed no action in July.

Foreign institutional investors

(FIIs) remained net buyers for the third consecutive month in July, pumping in

Rs 2,490.19 crore in the cash segment of the Indian market. In contrast,

domestic investors booked profits to the tune of Rs 10,007.88 crore, their

biggest monthly selloff in Calendar 2020.

After crashing to multi-year

lows in March, Indian markets made a smart comeback, rising nearly 50 percent

in five months on the back of ample liquidity injected by central banks across

the world in response to the coronavirus outbreak, record retail participation

and cheap valuations.

In July, the 50-share Nifty

rose 7.49 percent while the 30-pack Sensex logged 7.71 percent gains. The

broader markets participated in the rally with the Nifty Midcap 100 climbing 5.22

percent and Nifty Smallcap 100 surging 8.57 percent month-on-month.

Of the 35 sectors classified by

the BSE, foreign investors were net buyers in 14. Seventeen sectors saw

outflows and four witnessed no action from FIIs in July, data provided by

National Securities Depository Ltd (NSDL) shows.

The oil and gas sector was on

the top of FIIs' shopping list, raking in Rs 4,230 crore during the month. The

sector was among the worst hit in the COVID-19-led selloff in March but has

since been on FIIs' radar. It cornered Rs 7,195 crore of foreign money in the

June quarter.

Other sectors that FIIs bought

into include others (Rs 3,508 crore), software & services (Rs 2,030 crore),

automobiles & auto components (Rs 1,475 crore), consumer durables (Rs 1,047

crore), pharmaceuticals & biotechnology (Rs 970 crore) and insurance (Rs

812 crore)

BSE has classified around 4,700

issuers into 35 sectors. Any FII investment outside these issuers comes under

'others' category.

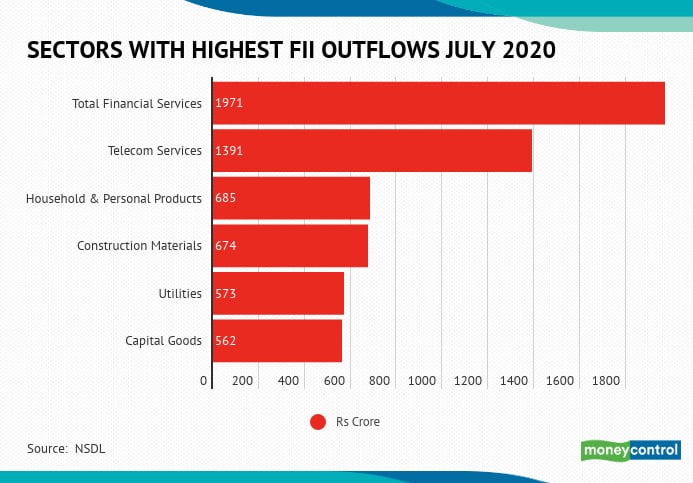

The biggest carnage was seen in Total Financial Services, which saw an outflow of Rs 1,971 crore. According to a BSE classification, the sector consists of banks and other financial services. Banks saw an FII exodus of Rs 1,409 crore and other financial services Rs 562 crore.

Financial institutions, holding

companies, housing finance companies, investment companies, NBFCs, asset

management companies and any other issuer dealing in financial services not

categorised as banks or the aforementioned sub-categories are categorised as

other financial services by BSE.

According to experts, even

though banks have shown limited signs of stress in their June quarter earnings,

the uncertainty over non-performing assets (NPAs), or bad loans, and the

general economic overhang kept foreign money on the sidelines.

In its Financial Stability

Report (FSR), the Reserve Bank of India (RBI) said the COVID-19 may result in the

Gross Non-Performing Assets (GNPA) increasing to 12.5 percent by March 2021 as

against 8.5 percent in March 2020.

As per Standard and Poor's

estimates (June 2020), gross NPA could rise to 13-14 percent for India.

Other sectors that foreign

investors exited in July include telecom services (Rs 1,391 crore), household

& personal products (Rs 685 crore), construction materials (Rs 674 crore),

utilities (Rs 573 crore) and capital goods (Rs 562 crore) among others.

The four sectors that saw no action in April were food and drugs

retailing, real estate investment, hardware technology & equipment and

sovereign.

Source - Moneycontrol.com

Comments

Post a Comment