CSB Bank is on its way to transform into a new age bank with a wider presence, offering varied products and using the latest available technology solutions for its operations

Highlights

-Q1 FY21 profit surges

-Gold loans dominate advances book

-Margins expand, operating efficiency improves

-Asset quality improves, credit cost falls

-Aims to transform to a new age bank with backing of a strong promoter

-Valuations reasonable, future looks promising

----------------------------------

CSB Bank a new entrant in the list of listed

private-sector lenders is a worthy investment option, even as the banking

sector faces pressure due to the economic uncertainty unleashed by COVID-19.

Ever since we published a note on the bank’s fourth-quarter FY20

earnings on June 16, its stock price has seen a sharp rally of around 60 percent.

Our continuing optimism on the stock meant we recommended it in our weekly

tactical pick in July-end.

Our main premise of CSB Bank as a good turnaround

story is playing out, as apparent in its earnings in the first quarter of the

current fiscal. CSB posted a net profit of Rs 54 crore in Q1 FY21, more than

double compared to the figure achieved in the same period last year. Its profit

surged despite the bank creating provisions of Rs 43 crore related to COVID-19.

Profits were aided by higher margins, better operating efficiency and lower

credit costs.

Capital, asset quality and growth are the three big

issues confronting banks today. CSB is scoring well on these parameters.

Till FY18, CSB was struggling with very low

capital. Its overall capital adequacy ratio at 8.33 per cent in March 2018 was

lower than the regulatory requirement of 10.785 per cent. With fresh equity

infusion of Rs 1,208 crore by the Fairfax group in FY19 and FY20, there is a

sharp increase in CSB’s net worth. The bank’s capitalisation is now strong with

capital adequacy ratio at 18.9 percent as of June-end. Moreover, it has assured

funding support from the group to meet its future capital requirements.

Talking about asset quality, the new management had

initiated a clean-up in the bank’s loan book. Consequently, its asset quality

has improved with the gross non-performing assets (GNPA) ratio coming down to

3.5 percent in June from 7.89 percent as of March 31, 2018. Around 18 percent

of the bank’s loans are under moratorium. Moreover, the bank’s healthy

provisional coverage ratio of 82 percent and additional provisions to meet

future contingencies is very encouraging.

While most banks are focusing on balance sheet

protection, CSB is one of the few banks that has growth plans for FY21. It

plans to open 100 branches in FY21. Pralay Mondal, a veteran banker, who

recently joined the bank shall focus on growing CSB’s retail banking business.

Mondal spearheaded the retail business of leading private banks like Axis and

HDFC Bank in his previous roles.

The bank’s loan book growth was modest at 6 per

cent in Q1 FY21 and was obviously impacted by the lockdown. However, gold

loans, which constitute 32 per cent of the total book, grew by 28 percent YoY

in Q1. The management intends to increase the share of gold loans to 40 percent

of the total loan book in the medium term.

CSB’s increased dynamism gets reflected in the fact

it is one of few small banks that participated in a big way in RBI’s liquidity

measures like TLTRO (Targeted long term repo operations), trying to boost

margins.

Overall, with a strong capital base after Fairfax’s

investment in CSB, investors can expect a bigger scale of operations and

improved profitability for the bank in the medium term.

Key highlights

CSB’s loan book stood at Rs 11,228 crore as at end

June. Management guided gold loans to grow by at least 25% in FY21. Also, with

Mondal at the helm of affairs, we can expect some traction in new verticals

like unsecured loans and MSME loans as well.

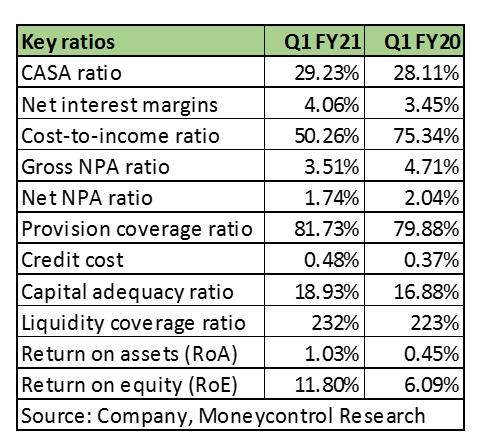

The overall deposit base of the bank grew by 8

percent in Q1. Thanks to the management’s conscious strategy of not focusing on

bulk deposits, low cost current and saving deposits (CASA) ratio improved to 29

percent in Q1, an increase of 112 bps YoY.

Net interest margin (NIM) improved owing to better

cost of funds and improved yield on advances. Average yield on

portfolio stood at 10.74 percent in Q1 due to higher yields on gold loans

against 10.22 percent a year ago.

Operating efficiency has been a big driver of

profits with operating expenses growth contained at 6%. Consequently, the

cost-to-income ratio significantly improved to 50 percent. That said, the ratio

will trend upwards in coming months as the bank opens new branches.

With the improvement in asset quality metrics,

credit costs have reduced and supported its earnings profile. The management

has guided for credit costs to remain below 1 percent in FY21. Thanks to

accelerated provisioning, the additional provisions amount to around 1.3% of

total loan book.

Capital adequacy ratio dipped compared to the

previous quarter (Q4 FY20) as both market and credit risk went up during the

quarter due to increased business activity.

Other takeaways

Bank may consider inorganic opportunities to grow

in the banking sector.

The management indicated that the parent Fairfax

will participate in the government’s plans to privatise 4 public sector banks.

Valuation and view

Overall, with the backing of the Fairfax group, a

professional management running the show and adequate capital, CSB is now

re-aligning its business model and is on its way to transform into a new age

bank with a wider presence, offering varied products and using the latest

available technology solutions for its operations.

The bank’s stock price has seen a sharp rally of in

last couple of months and surged over 10 percent yesterday on reporting stellar

Q1 earnings. At the current price of Rs 225, the bank is trading at 1.7

times its FY22 estimated book value. The valuation looks reasonable considering

improving return ratios and a promising outlook. Despite the rally, we see

interest in the stock sustaining as it is one of the few banks reporting

earnings growth which can sustain its stock price uptrend in the near term.

In the long term, the stock can be re-rated if the

bank succeeds in transforming itself into a new age bank. That said, execution

risks remain and a weak macroeconomic environment aggravated by the outbreak of

COVID-19 can delay CSB’s progress.

Long term investors looking for growth story in the

banking space should buy the stock on dips.

Source - Moneycontrol.com

Comments

Post a Comment