If the Nifty50 moves up, the key resistance levels to watch out for are 11,498.7 and 11,532.9.

The market closed a volatile session moderately higher on

September 11 as India and China agreed on a five-point road map, including

quick disengagement of troops and avoiding any action that could escalate

tensions, to resolve the border standoff.

The Sensex gained 14.23 points to close at 38,854.55, while the

Nifty50 rose 15.20 points to 11,464.50, forming a Doji pattern on the daily

charts and climbed over a percent for the week to witness a bullish candle on

the weekly scale after the formation of a significant Bearish Engulfing pattern

in the previous week.

"The upside bounce of Thursday session is holding with

range-bound action on Friday. Any upside attempt is limited up to 11,500-11,600

levels for the next week, but there is a higher chance of selling pressure

emerging from the highs," Nagaraj Shetti, Technical Research Analyst at

HDFC Securities told Moneycontrol.

Until 11,600 level is crossed decisively on the upside, the

near-term bearish trend status and the initial downside target of 11,000

remains intact for the market, he said.

The broader markets outperformed benchmark indices. The Nifty

midcap index gained 0.7 percent and the smallcap was up 0.3 percent.

We have collated 15 data points to help

you spot profitable trades:

Note: The open interest (OI) and volume data

of stocks are the aggregates of three-month data and not of the current month

only.

Key support and resistance levels for

the Nifty

According to pivot charts, the key support levels for the Nifty

is placed at 11,425.1 followed by 11,385.7. If the index moves up, the key

resistance levels to watch out for are 11,498.7 and 11,532.9.

Nifty Bank

The Bank Nifty also ended moderately higher on September 11 with

13.80 points gains at 22,480. The important pivot level, which will act as

crucial support for the index, is placed at 22,234.27, followed by 21,988.63.

On the upside, key resistance levels are placed at 22,697.17 and 22,914.43.

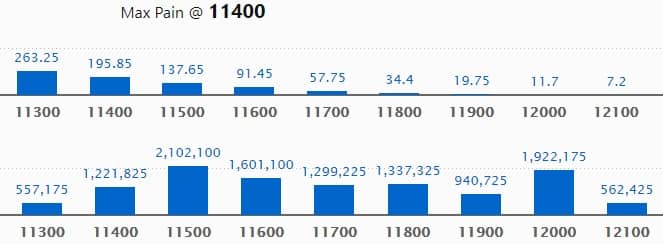

Call option data

Maximum Call open interest of 21.02 lakh contracts was seen at

11,500 strike, which will act as a crucial resistance in the September series.

This is followed by 12,000 strike, which holds 19.22 lakh

contracts, and 11,600 strike, which has accumulated 16.01 lakh contracts.

Call writing was seen at 12,000 strike, which added 2.01 lakh

contracts, followed by 11,500, which added 1.85 lakh contracts, and 12,200

strike that added 1.63 lakh contracts.

Call unwinding was seen at 11,400 strike, which shed 1.02 lakh

contracts, followed by 11,300 strike that shed 78,525 contracts.

Read Full article - Click Here

Comments

Post a Comment