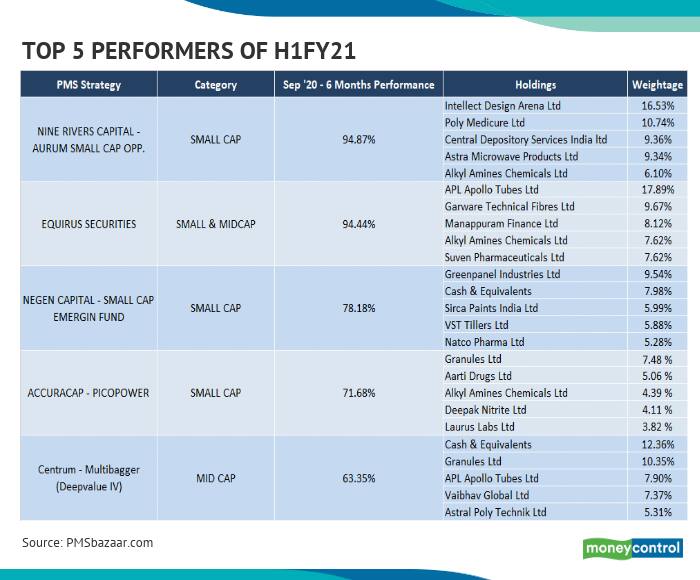

PMS schemes that gave more than 50 percent return include Nine River Capital’s AURUM Smallcap theme that delivered nearly 95 percent return in the last six months.

When India was grappling with lockdown to avoid the spread of COVID-19,

portfolio managers used the dip in March to stay with possible winners

of the ‘Unlock’ scenario in the small & midcap space.

Indian market might have rallied by about 30 percent in the first six

months of the current financial year, but as many as 80 Portfolio Management

Schemes (PMSes) outperformed the index and 20 of them rose 50-100% in the same

period, according to data from PMSBazaar.com.

PMS schemes that gave more than 50 percent return include Nine River

Capital’s AURUM Smallcap theme that delivered nearly 95 percent return in the

last six months. Top holdings include stocks like Intellect Design, Poly

Medicure, CDSL, Astra Microwave and Alkyl Amines Chemicals.

Aurum Small cap opportunities strategy is built out of 12-15 high

conviction small-cap stocks with a market-cap of more than Rs 2,500 crore and

an investment horizon of 3-5 years for each stock.

The other PMS schemes which rallied more than 50 percent include Equirus

Securities Long Horizon Fund. The fund focuses on making concentrated bets for

the long term, in high quality publicly listed Indian companies at reasonable

valuations.

Newgen Capital’s Smallcap Emerging Fund, and ACCURACAP PICOPOWER

Smallcap fund delivered more than 70 percent returns each in the last six

months.

Centrum Multibagger which is a Midcap focussed fund gave over 60 percent

return in the last six months. The strategy focuses on buying value stocks in

the Midcap space to create value over the long term compared to its benchmark

BSE500.

The top holding of this fund includes Granules, APL Apollo, Vaibhav

Global, and Astral Poly Technik Ltd etc. among others.

Will the rally continue in small & midcaps?

The large part of the outperformance came from the PMS schemes which

invest primarily in the broader market space. Money managers are looking for

growth and after 2 years of underperformance - small & midcaps are ready to

shine, suggest experts.

With the government focussing primarily on the Make in India initiative,

small & midcaps are more economy-linked companies and do well when the

economy does well.

The initial part of outperformance which we have seen can be attributed

to liquidity, but experts feel that staying invested in companies where growth

outlook remain string could turn out to be wealth creators.

“As long as the market rally is driven by liquidity, small & midcap

stocks will continue to underperform. Clear visibility of earnings improvement

is of utmost importance for small & midcap stocks to outperform from hereon

or even sustain this rally,” Arjun Mahajan Head Institutional Business at

Reliance Securities told Moneycontrol.

“Few indicators such as improvement in power demand, credit card bills,

e-way bills, railway freight, etc give an indication about possible earnings

recovery, prudent investors may take a while to confirm the sustainability of

this recovery,” he said.

Mahajan further added that we can essentially say that a strong rally of

small & midcap is very much on the cards if backed by the sustained

economic recovery.

Source - Moneycontrol.com

Comments

Post a Comment