The maximum profit of 190 points could be gained if the Bank Nifty expires at or above 25,000.

Markets regained control after pausing in the previous week and witnessed a tug of war between the bulls and the bears. During the week, the Nifty traded in a range of merely 240 points. It also formed a Spinning Top candlestick pattern on the weekly scale, which indicates indecisiveness among participants. The index faced stiff resistance at 12,000 and made multiple attempts unsuccessful attempts to go past it.

We reiterate that 12,000 is an extension of the rising trend line, which has acted as a supply zone for the markets in the past couple of weeks. Only a close above 12,000 will bring the bulls back, propelling the index towards a life high. A breach of 11,800 can intensify the panic in the market, pulling the index down to 11,600 levels.

The momentum indicators and oscillators have reached the overbought territory on the daily chart and profit booking at higher levels can't be ruled out. Thus, one needs to be cautious on leveraged positions.

The volatility index 'India VIX' has formed a base where the support is placed at 15 levels and major resistance is at 25 levels. Hence, a move beyond the 24-25 range would be considered as a breakout and could be a cause of concern for the bulls.

In the coming week, we have F&O expiry for the October series. The options data indicates that a Put writing was seen at 11,700, 11,800, and 11,900 strikes where the highest open interest is still placed at 10,500 strike and the second-highest open interest is placed at 11,500 strike.Broader markets have outperformed and are also hinting at a fresh positive momentum on the higher side. Thus, a defensive trader needs to adopt a stock-specific approach in this space.

A continuous Call writing was seen at 12,000 strike, which also holds the second-highest open interest of nearly 38 lakh contracts and the highest open interest is placed at 12,500 strike. If the Nifty breaks above 12,000, then we can expect a strong short-covering move towards 12,200. Overall option data indicates that the coming week is likely to be more volatile and it may oscillate in a broader range of 11,700-12,200.

The BankNifty index outperformed the Nifty to form a small bullish candle on the weekly scale. It is making a higher top and higher bottom formation on the daily chart and also taking the support of a rising trend line connecting all the lows starting with 20,430 levels, where the immediate support is placed at 23,800.

The ratio of Bank Nifty to Nifty is at 2.05, which is still very low and shows that Bank Nifty may outperform. The major hurdle for the Bank Nifty is placed at 25,000 and above that, we can expect a fresh rally towards 25,500. The immediate support is at 23,500. A breach will again put the index under pressure.

On the options front, the maximum open interest on the P side is placed at 24,000 strike which will act as immediate support whereas the highest open interest on the Call side is placed at 25,000 strike.

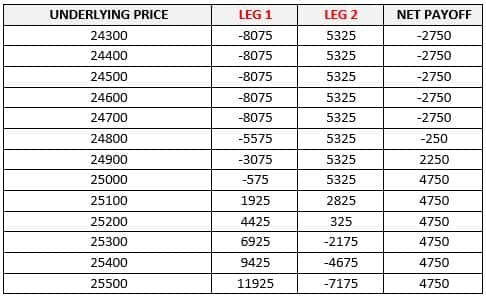

Based on the data of the Bank Nifty, in the coming week, we are expecting a moderate upmove towards 25,000. So, we are advising to initiate a Bull Call Spread where one can buy 1 lot of 24,700 strike at 323, simultaneously sell 1 lot of 25,000 strike at 213. So, the total outflow from this strategy is 110 points as per the closing price on October 23.

The maximum profit of 190 points could be gained if the Bank Nifty expires at or above 25,000. The breakeven level comes at 24,810. Since the strategy is initiated with an outflow of 110 points, the downside risk is limited to 110 points if the Bank Nifty expires at or below 24,700 levels.

The payoff table

Comments

Post a Comment