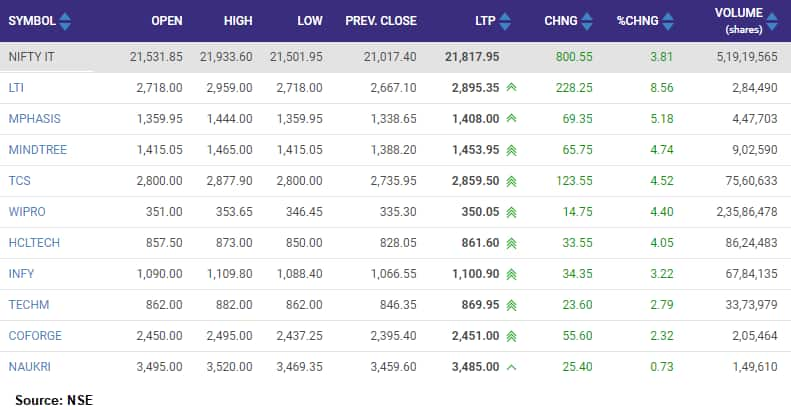

Wipro added over 4 percent after the IT firm said its Board will consider a buyback plan on October 13. L&T Infotech, Infosys, HCL Tech, Mphasis, Tech Mahindra and Mindtree were the other gainers.

The Indian stock market is

trading higher for the sixth day in a row with Sensex jumping 479.35 points or

1.2 percent at 40358.30, and the Nifty gaining 132.20 points or 1.13 percent at

11871.10.

The market rally was largely

aided by IT stocks with the index jumping almost 4 percent led by index

heavyweight Tata Consultancy Services (TCS) which hit new high.

The company reported a profit

after tax of Rs 7,475 crore for the quarter ended September 2020, registering a

6.7 percent sequential growth. The board members of the company have approved a

proposal to buy back up to 5,33,33,333 equity shares of company, being 1.42

percent of the total paid up equity share capital, at around Rs 3,000 per

equity share for an aggregate amount up to Rs 16,000 crore.

Research and broking firm

ICICIdirect has upgrade TCS from hold to buy with target at Rs 3,300 per share.

The company is expected to be a key beneficiary of this trend leading to

double-digit revenue growth over a sustainable period. This, coupled with industry

leading growth & solutions, better capital allocation, stable management

and higher revenue growth trajectory than witnessed in the past warrant a

multiple re-rating for the company, it said.

The other gainers included Wipro

which added over 4 percent after the IT firm said its Board will consider a

buyback plan on October 13. The announcement comes on a day when larger rival

Tata Consultancy Services Board has cleared an up to Rs 16,000 crore buyback

plan.

L&T Infotech, Infosys, HCL

Tech, Mphasis, Tech Mahindra and Mindtree were the other gainers adding 2-7

percent each.

Vikas Jain, Senior Research

Analyst at Reliance Securities is of the view that for Wipro, the last calendar

year highs of Rs 300 levels have been broken out with strong volumes and we

expect to outperform even from current levels. Weekly RSI is also trading near

70 levels which indicates there is a lot of room on the upside.

The IT stocks to have hit new

52-week high included Mphasis, Mindtree, HCL Tech, Infosys, Tech Mahindra,

Coforge and Hexaware Technologies.

Disclaimer: The views and investment tips expressed by

experts on Moneycontrol.com are their own and not those of the website or its

management. Moneycontrol.com advises users to check with certified experts

before taking any investment decisions.

Comments

Post a Comment