Deal with KKR marks the second monetisation in Reliance Retail

Highlights

- KKR to invest Rs 5,550 crore for a 1.28 percent

stake in Reliance Retail

- Deal

values Reliance Retail at Rs 4.33 lakh crore

- Synergy

benefit with Future Retail will drive future upside

- RIL

shareholders should see further upside with two engines of growth firing

Reliance Industries

continued to walk the path it had clearly mentioned in its annual general

meeting earlier this year. Then, it had announced that it was looking for

strategic as well as financial investors for its retail venture. After the

acquisition of Future group’s wholesale and retail businesses for Rs 25,000

crore in the last week of August, Reliance Industries has now started

monetising its stake in Reliance Retail. After Silver Lake committed to buy a

1.75 percent stake for Rs 7,500 crore, KKR has now decided to invest Rs 5,550

crore in the retail unit. Its price for a 1.28 percent stake in Reliance Retail

Ventures values the entity at Rs 4.33 lakh crore. KKR had already committed a

Rs 11,367-crore investment in Jio Platforms.

As per various reports, India’s

retail market is likely to be around $1.5 to $2.0 trillion by 2030 of which

organized retail is likely to be around $400 billion and the e-commerce market

is likely to be around $300 billion. Presence in both the online and offline

channels will help Reliance Retail in tapping both the opportunities. With the

acquisition of the Future group’s retail assets, segments such as lifestyle and

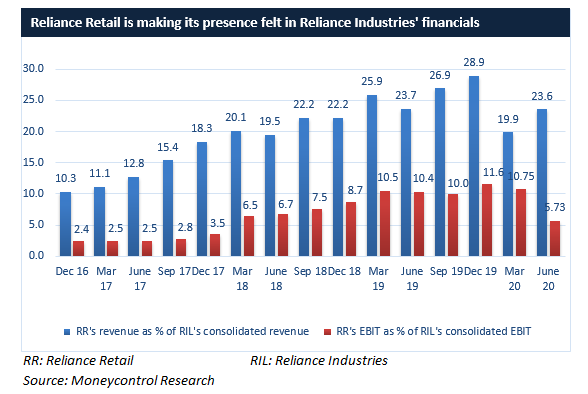

grocery will become big contributors. Already Reliance Retail has become a big

vertical of RIL over time. The pandemic-induced lockdown had adversely impacted

growth in the retail sector. However, with the gradual opening up of the

economy, we expect Reliance Retail to return to the growth path.

Creating room for future

growth while keeping the balance sheet light

A key strategic move by RIL has

been to improve the quality of its balance sheet. Helped by 14 bulge-bracket

deals and a Rs 53,000-crore rights issue, the company achieved its zero net

debt target much before the deadline. Overall, capital raised has been to the

tune of Rs 2.13 lakh crore well above the reported consolidated debt numbers.

Of this, about Rs 23,000 crore would be retained at the Jio Platform level.

Table: RIL’s

net cash post investments

Source: Moneycontrol Research,

RIL

With the requisite growth capital

available to Jio, the time is now ripe for RIL to fire up another growth engine

— the retail segment. The stake sale in Reliance Retail will provide

growth capital and help it reduce debt. As on March 31, 2020, Reliance Retail

had a debt of Rs 4,618 crore.

Coming to valuations, Reliance Industries’ current market cap is around Rs 15 lakh core.

The KKR investment is slightly

above Silver Lake’s valuation. However, since it is a very small private equity

investment, it shouldn’t be seen as the only benchmark for the valuation of

Reliance Retail. The way Reliance is using JioMart along with the Whatsapp

platform and its large offline presence, achieved through the acquisition of

Future’s business, we expect the retail business to be significantly re-rated

in the future.

Comments

Post a Comment