We could see a sharp trading rally in Shriram Transport if the health scare abates or the risk on trade makes a comeback. So, this is a stock for the risk taker and best avoided by a conservative investor

Highlights

-

Stock has underperformed the index year to date

- Growth in slow lane

- Moratorium picture has

improved

- Higher provision for Covid

mars profit and provision could remain high

- Asset quality improves in

the quarter but future looks uncertain

- Diversified funding a

positive, rights issue provided further capital buffer

- Valuation attractive, but inherent

volatility makes it a stock for risk takers

Shriram Transport has been a big under- performer in the

market despite the stock rallying from its nadir hit in March. The stock has

risen 41 per cent from its March lows as against 48 per cent for the Nifty

index. The insipid show by Shriram Transport is a bit surprising because the

rural sector, which is a key market for the company, is looking up on the back

of a good monsoon and lockdown restrictions are increasingly being eased.

Moreover, the recent rights issue has given enough capital cushion to the

company to face the probable rainy day. Then what ails this leader of second

hand vehicle financing, despite the segment remaining relatively insulated

compared to first hand CVs?

We see growth to be a

challenge even beyond Covid

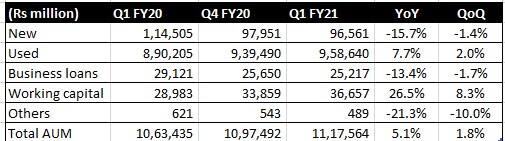

Growth was quite tepid in the last reported quarter. Used

vehicles and working capital drove the overall year-on-year (YoY) growth in

assets under management (AUM) to 5 per cent. Disbursements declined by close to

92 per cent YoY.

Source: Company

However, this is not a one-time decline as the pace of growth

had been decelerating for the last several quarters. While the rural segment is

doing better (40 per cent of AUM comes from rural), the overall sluggishness in

the economy would be a key impediment to growing a relatively large book unless

Shriram dilutes its underwriting standards.

Asset quality – good but not out of the

woods yet

In the last reported quarter, asset quality was stable with

gross and net stage 3 assets at 7.98 per cent and 5.06 per cent of total assets

respectively as against 8.36 per cent and 5.62 per cent in the previous

quarter. In fact, collection that had fallen during the lockdown — from 84 per

cent in March to 23 per cent in April and rose to 52 per cent in May — recovered

in July and stood at 73 per cent in terms of borrowers and 53 per cent in terms

of value. While this means that the moratorium book has reduced from close to

70 per cent by value in May, it remains large enough to warrant caution.

Credit cost to remain a drag on

profit

The historic credit cost of Shriram Transport has been around 2

per cent of assets. In the quarter gone by, the reported profit was pulled down

by a Covid provision of Rs 956 crore. The total Covid provision is close to Rs

1,866 crore, which is a little over 3 per cent of the moratorium book. We have

factored in a very high level of credit cost in FY21e.

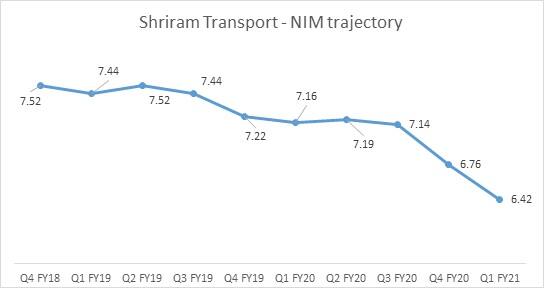

Margins under pressure

The company has seen a steady decline in its margins thanks to

more than adequate liquidity and competitive rates on yield on advances. The

buffer liquidity and SLR investments as of August was Rs 9,687 crore and Rs

1,822 crore respectively. The company has also raised Rs 1500 crore by way of a

rights issue that should shore up its capital adequacy ratio, which is already

comfortable at 21.9 per cent.

Source: Company

What are the redeeming features?

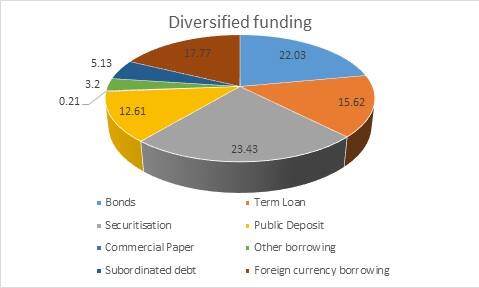

Shriram Transport Finance is a large deposit taking NBFC and a

likely survivor post the mayhem that is sweeping the NBFC universe. It has a

diversified funding base and could continue to garner funds from different

sources, including foreign borrowings and banks. It may be noted here that

on-lending to NBFCs is now considered a part of bank’s priority sector

exposure. So we do not foresee a structural liquidity challenge.

Source: Company

While short-term asset quality hiccup cannot be ruled out, we

draw comfort from the fact that for 70 per cent of the borrowers, the vehicles

are back on the road. Moreover, with a distinctive preference for used vehicles

by the rural population, the increase in farm income due to a good harvest and

a normal monsoon should augur well for demand as well as asset quality. Should

the much-awaited scrappage policy get implemented, it could breathe new life to

the commercial vehicle segment.

However, for Shriram, in addition to the growth and asset

quality worries, there is the looming risk of the merger with group companies.

Such a merger will dilute the unique characteristics of its expertise in the

used vehicle market. This isn’t imminent though owing to the ongoing pandemic.

Earnings could remain volatile as nearly half of the loan by value goes to

heavy commercial vehicles where economic slowdown could adversely impact

freight rates and cash flow of borrowers.

Source: Company, Moneycontrol Research

We have assumed a subdued loan growth in FY21 and a much higher

credit cost than what has been indicated by the management, thereby resulting

in a substantial near-term earnings decline. However, a recovery is likely in

FY22e. While valuation looks particularly attractive from the FY22e

perspective, the stock might remain volatile. We could see a sharp trading

rally if the health scare abates or if the risk on trade makes a comeback. So

this is a stock for the risk taker best avoided by a conservative investor.

Comments

Post a Comment