Jefferies has maintained a buy rating on the stock with the target at Rs 315 per share. It is of the view that the company should achieve 6-7 msf/year medium-term volume target.

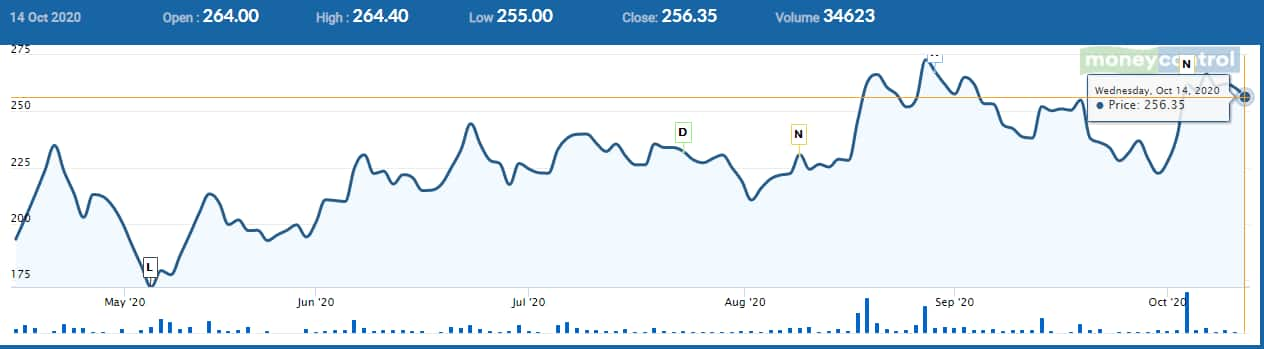

Sobha share price was trading lower by half a percent in the morning session on October 14. The stock, which has added over 40 percent in the last six months, was trading at Rs 258.15, down Rs 1.90, or 0.73 percent at 0946 hours. It touched an intraday high of Rs 264. and an intraday low of Rs 256.10.

Global research firm Jefferies has maintained a "buy" rating on the stock with the target at Rs 315 per share. It is of the view that the company should achieve 6-7 msf/year medium-term volume target, according to a CNBC-TV18 report.

Sobha will business returning to normal soon, with customer inquiries nearing pre-COVID levels. Demand is driven by white-collar workers where salaries haven't declined. The company expects launches to resume from Q3. It also sees consolidation accelerating post-COVID.

Last week, CLSA maintained an "outperform" call on the stock. The global research firm retained the rating and raised the target to Rs 270 from Rs 252 per share. The company reported a sharp recovery in its pre-sales to 0.9 million square feet. Industry sales in Bengaluru are still 50 percent below pre-COVID level.

It has seen a marginal increase in debt due to its dividend payment in Q2 and has increased its presales estimates for FY21-23.\

According to Moneycontrol SWOT Analysis powered by Trendlyne, RSI is indicating price strength with the stock showing the highest recovery from 52-week low.

Moneycontrol technical rating is very bullish with moving averages and technical indicators being bullish.

Comments

Post a Comment